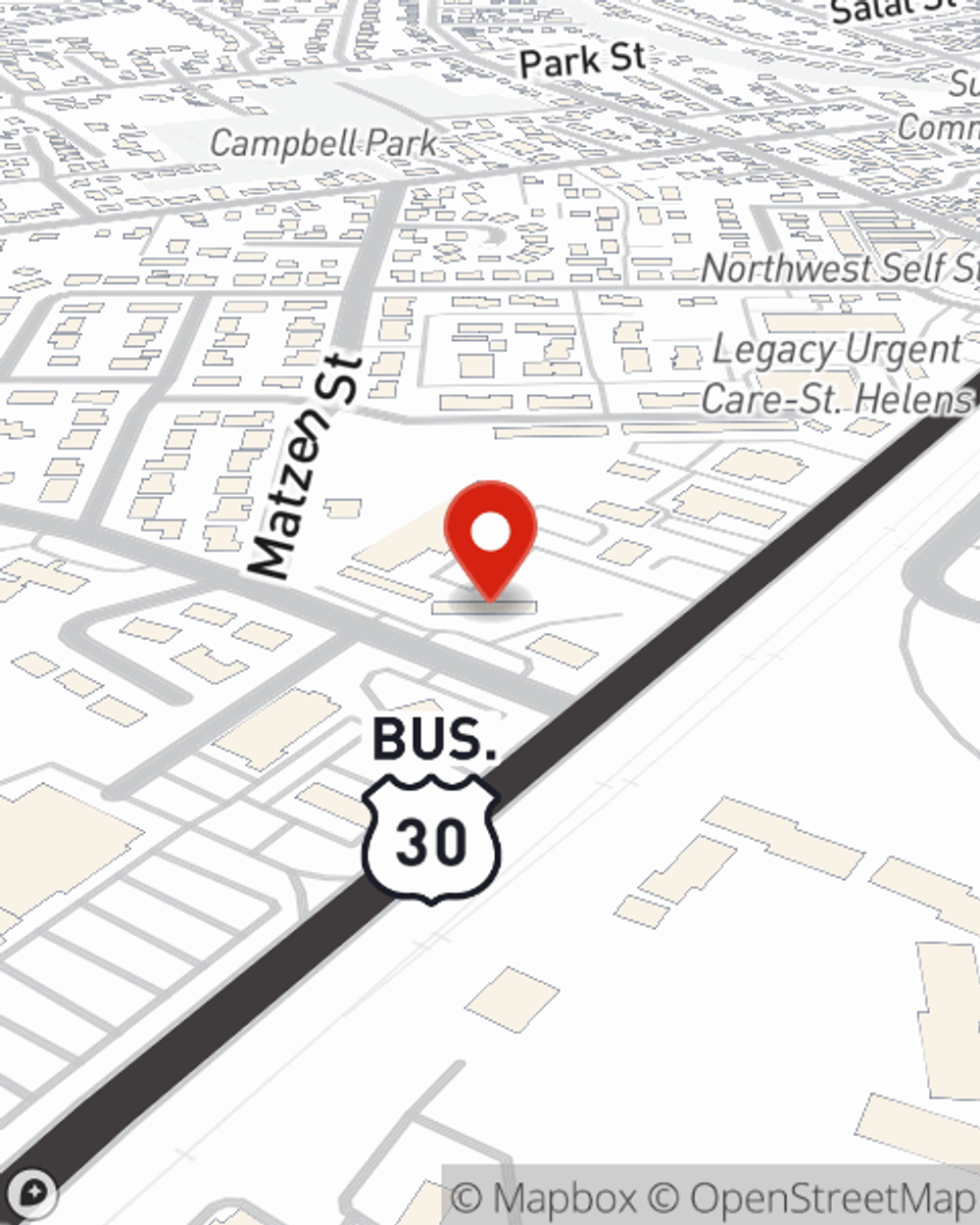

Business Insurance in and around St Helens

Calling all small business owners of St Helens!

Cover all the bases for your small business

Your Search For Fantastic Small Business Insurance Ends Now.

It takes courage to start your own business, and it also takes courage to admit when you might need support. State Farm is here to help with your business insurance needs. With options like errors and omissions liability, a surety or fidelity bond and business continuity plans, you can rest assured that your small business is properly protected.

Calling all small business owners of St Helens!

Cover all the bases for your small business

Strictly Business With State Farm

When you've put so much personal interest in a small business like yours, whether it's a music school, a beauty salon, or an alteration shop, having the right coverage for you is important. As a business owner, as well, State Farm agent Joel Avina understands and is happy to help with customizing your policy options to fit what you need.

Contact agent Joel Avina to consider your small business coverage options today.

Simple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Joel Avina

State Farm® Insurance AgentSimple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".